About Conti

Continental Grain Company (Conti) is a privately-owned global investor, owner, and operator of companies with more than 200 years of history across the food and agribusiness spectrum. We seek to create long-term value by applying deep industry knowledge, capital, and talent to businesses ranging from established market leaders to promising innovators. We build platforms that leverage our strategic expertise in food production, processing, and distribution to source proprietary deals, working alongside trusted partners and supporting strong management teams. We bring a long-term ownership mindset, concentrating on investment and operating plans that seek to create enduring value and a sustainable, efficient, and nutritional food supply chain. Conti brings people, ideas and resources together to build the businesses that will feed the world.

Our history & heritage

Our history & heritage

Early Years in Europe, Planting Seeds of Growth

Simon Fribourg founds a small grain-trading firm in Arlon, France (now Belgium).

When Belgium is struck by famine, Simon Fribourg’s son, Michel, makes the perilous trip to Bessarabia (now Romania) carrying sacks of gold to buy grain to be shipped back home.

With trade expanding in Europe, Arthur Fribourg establishes operations in Antwerp. Partnering with his father and brother, he also builds flour mills in Belgium and Luxembourg.

As normalcy returns after the First World War, brothers Jules and René Fribourg start Compagnie Continentale d’Importation (CCI) in Antwerp and later Paris. CCI will grow into a trading firm spanning Europe and Asia.

Simon Fribourg founds a small grain-trading firm in Arlon, France (now Belgium).

When Belgium is struck by famine, Simon Fribourg’s son, Michel, makes the perilous trip to Bessarabia (now Romania) carrying sacks of gold to buy grain to be shipped back home.

With trade expanding in Europe, Arthur Fribourg establishes operations in Antwerp. Partnering with his father and brother, he also builds flour mills in Belgium and Luxembourg.

As normalcy returns after the First World War, brothers Jules and René Fribourg start Compagnie Continentale d’Importation (CCI) in Antwerp and later Paris. CCI will grow into a trading firm spanning Europe and Asia.

Opportunity Emerging in the U.S.

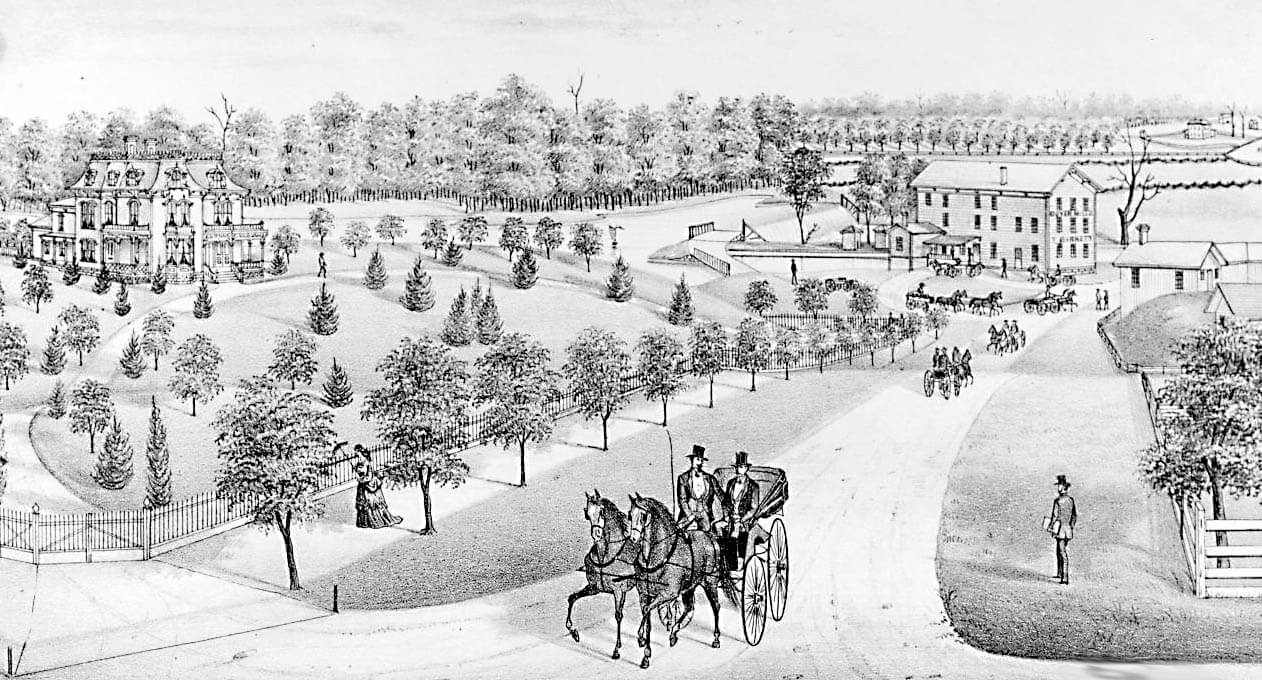

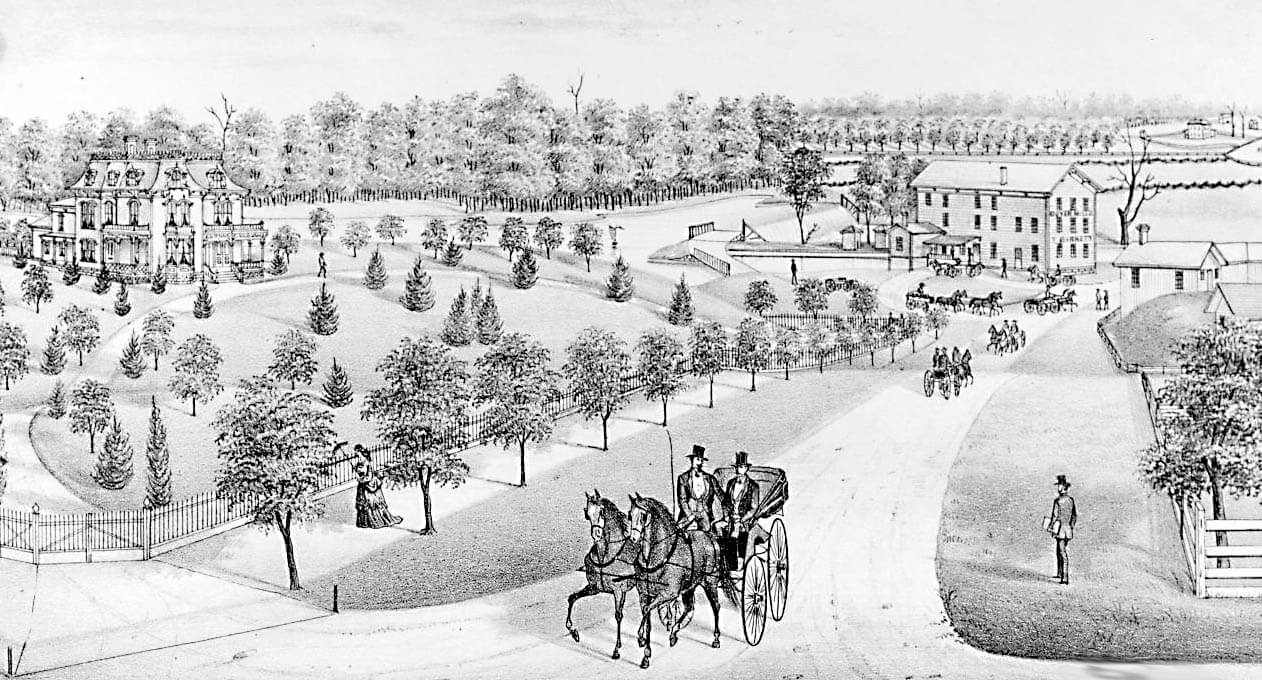

With the Midwestern U.S. emerging as a global grain powerhouse, Jules opens Continental Grain Company, with a seat on the Chicago Board of Trade and an office in New York City.

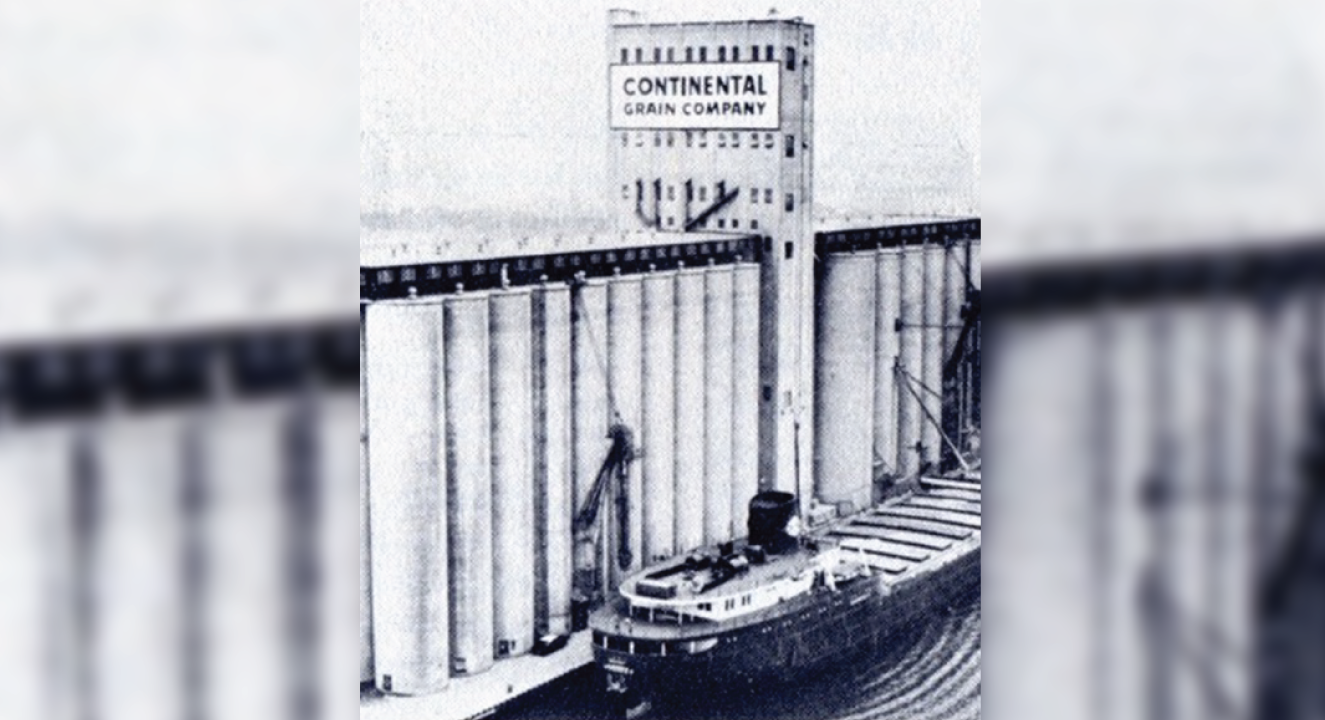

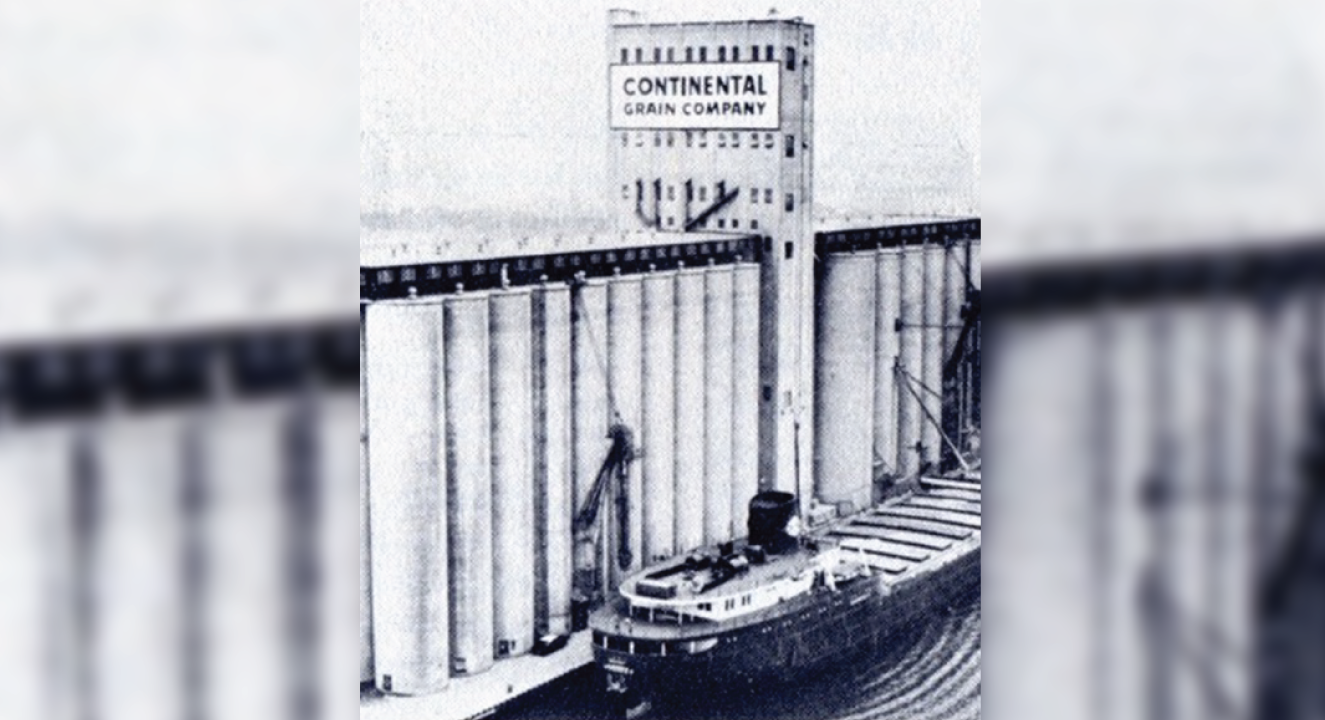

Continental Grain expands its capacity to export grain from the U.S. to global markets, building a network of grain elevators and terminals.

As the Nazi advance threatens Europe, the Fribourg family emigrates to the U.S. Their circuitous route takes them from Lisbon to Santo Domingo aboard a Continental Grain freighter, before reaching New York.

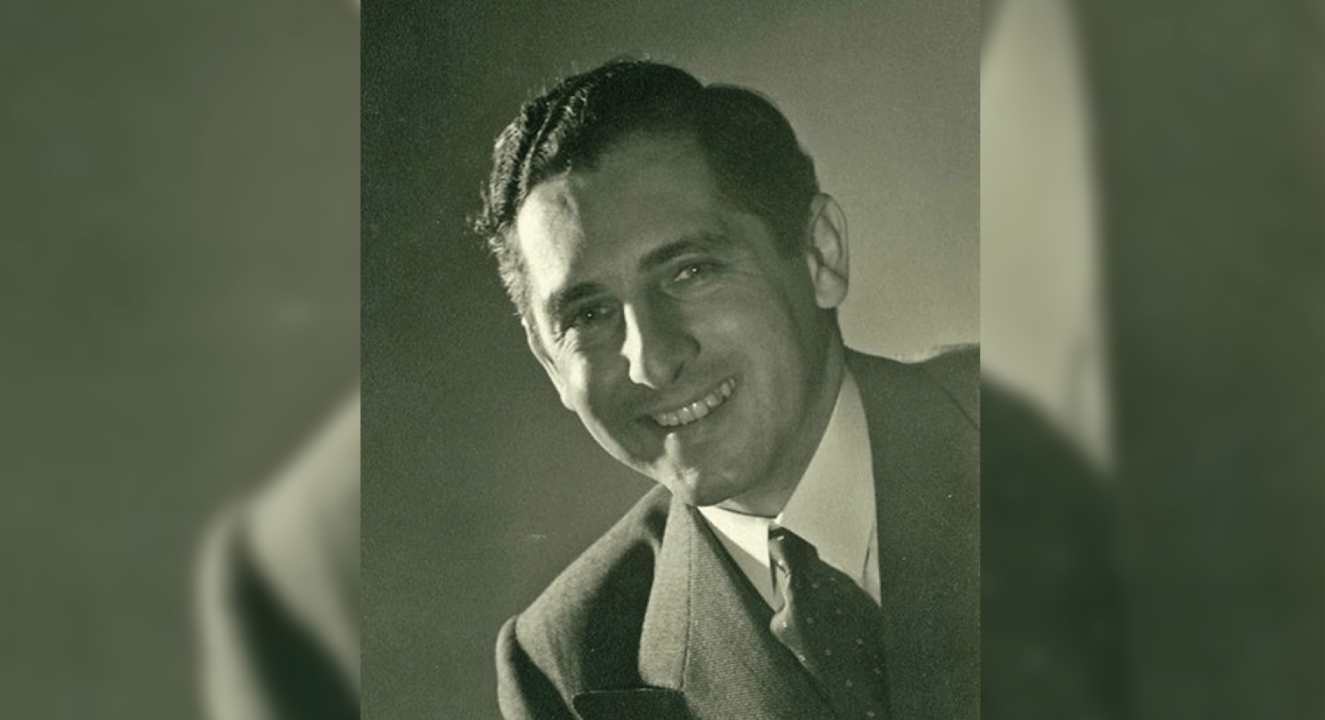

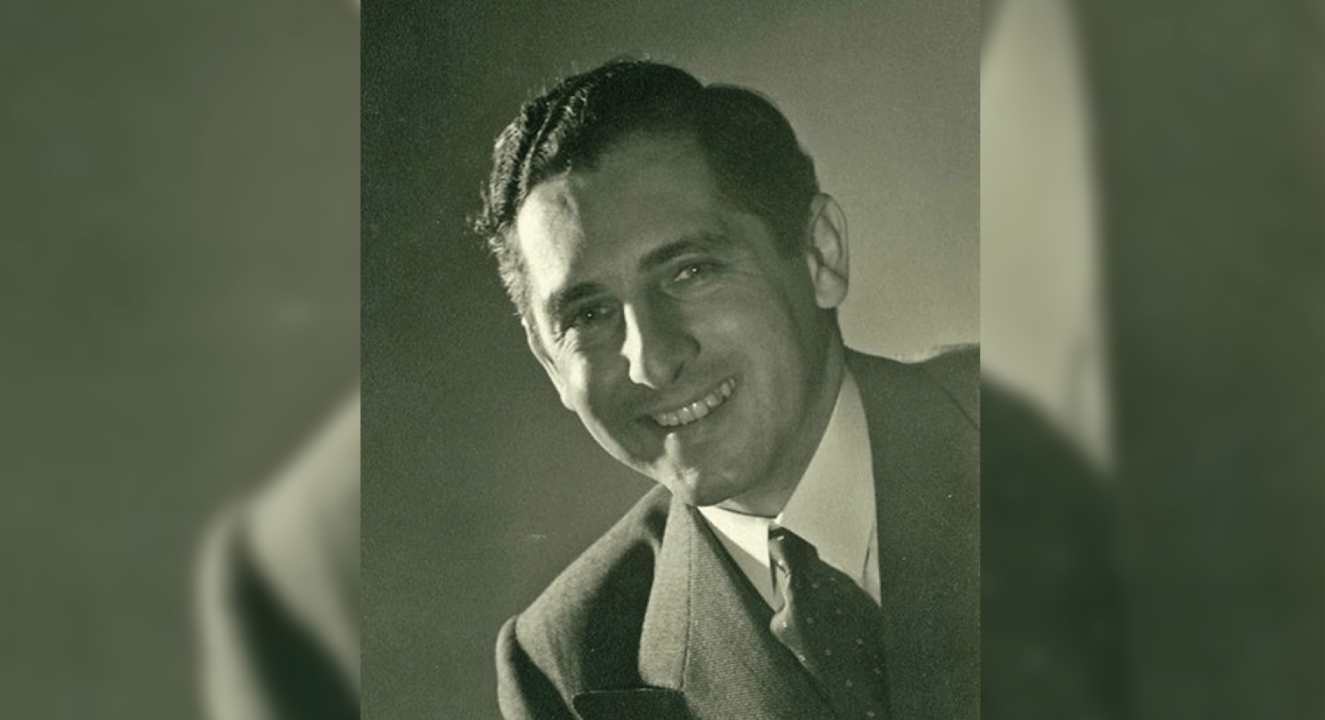

Now led by Michel Fribourg and headquartered in New York City, Continental Grain is emerging as one of the largest private grain companies, whose processing, storage and transport network extends from farmers to consumers around the world.

With the Midwestern U.S. emerging as a global grain powerhouse, Jules opens Continental Grain Company, with a seat on the Chicago Board of Trade and an office in New York City.

Continental Grain expands its capacity to export grain from the U.S. to global markets, building a network of grain elevators and terminals.

As the Nazi advance threatens Europe, the Fribourg family emigrates to the U.S. Their circuitous route takes them from Lisbon to Santo Domingo aboard a Continental Grain freighter, before reaching New York.

Now led by Michel Fribourg and headquartered in New York City, Continental Grain is emerging as one of the largest private grain companies, whose processing, storage and transport network extends from farmers to consumers around the world.

Reaching New Markets, Diversifying Businesses

When the Soviet Union’s wheat harvest failed, Continental Grain became the first U.S. firm to export grain to the U.S.S.R., providing 1 million metric tons of wheat to alleviate the crisis.

Setting the stage for its expansion into the poultry industry, Continental Grain acquires a majority stake in Allied Mills, a producer of livestock feed and fresh poultry.

Continental Grain purchases Compañía Algodonera Paraguay S.A. (CAPSA), known today as ContiParaguay. It is our longest held operation in Latin America.

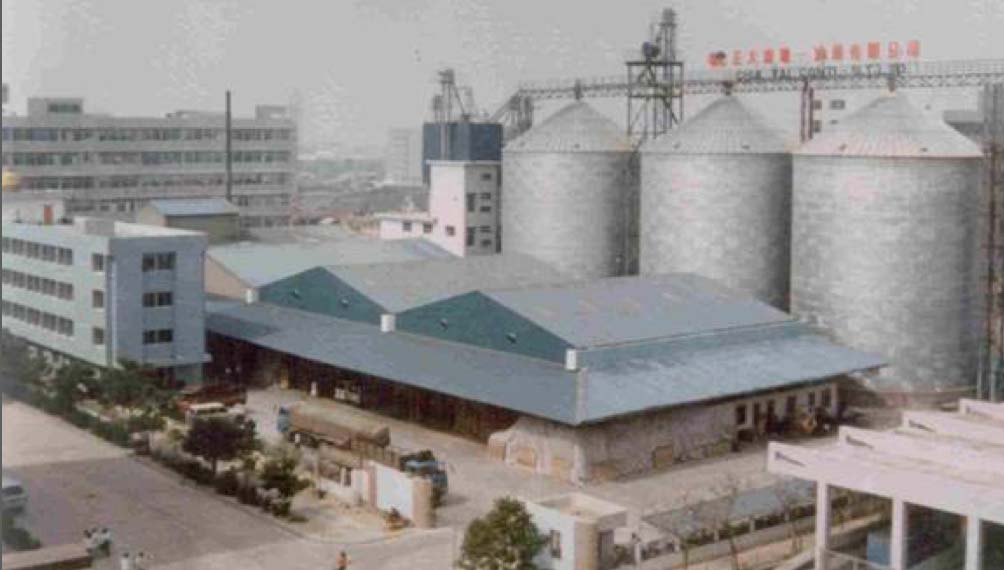

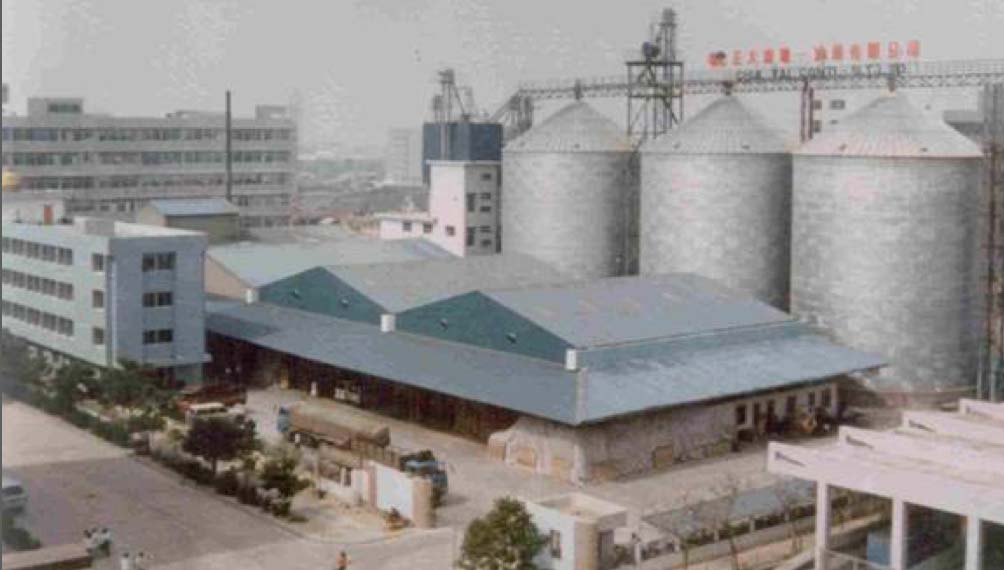

The first foreign-owned feed mill in China is opened by Continental Grain in a joint venture with Charoen Pokphand, paving the way for further expansion into China.

Business License Number 0001 for overseas investment in China, granted in 1981.

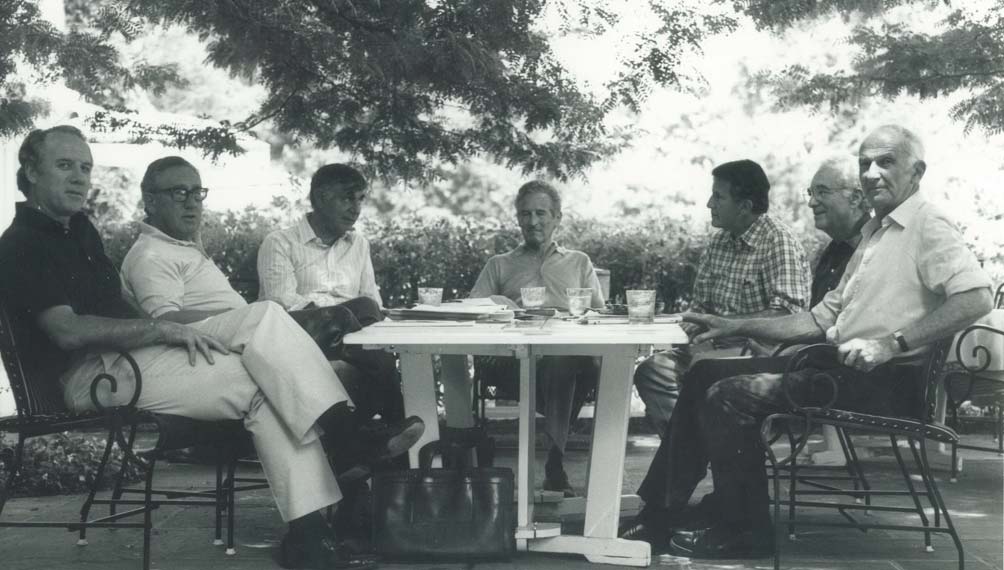

Continental Grain establishes an independent Board of Directors, including Ron Daniel, Morton Sosland, Arthur Liman, Henry Kissinger, James Wolfensohn, and Olivier Wormser as founding members.

After serving in a variety of roles at the company since 1976, Paul Fribourg is named Chairman and CEO, becoming the 6th generation of the Fribourg family to lead Continental Grain.

Continental Grain merges its hog farming operations into Premium Standard Farms. After a series of mergers, the business will become part of the leading integrated pork company in the U.S., Smithfield Foods.

When the Soviet Union’s wheat harvest failed, Continental Grain became the first U.S. firm to export grain to the U.S.S.R., providing 1 million metric tons of wheat to alleviate the crisis.

Setting the stage for its expansion into the poultry industry, Continental Grain acquires a majority stake in Allied Mills, a producer of livestock feed and fresh poultry.

Continental Grain purchases Compañía Algodonera Paraguay S.A. (CAPSA), known today as ContiParaguay. It is our longest held operation in Latin America.

The first foreign-owned feed mill in China is opened by Continental Grain in a joint venture with Charoen Pokphand, paving the way for further expansion into China.

Business License Number 0001 for overseas investment in China, granted in 1981.

Continental Grain establishes an independent Board of Directors, including Ron Daniel, Morton Sosland, Arthur Liman, Henry Kissinger, James Wolfensohn, and Olivier Wormser as founding members.

After serving in a variety of roles at the company since 1976, Paul Fribourg is named Chairman and CEO, becoming the 6th generation of the Fribourg family to lead Continental Grain.

Continental Grain merges its hog farming operations into Premium Standard Farms. After a series of mergers, the business will become part of the leading integrated pork company in the U.S., Smithfield Foods.

Sharpening the Strategic Focus

Launching a new era, the worldwide commodity marketing business is sold, and Continental Grain is reorganized as a holding company so each business can function more independently.

Wayne Farms LLC, which includes Continental Grain’s poultry business, is established as a standalone entity and will become one of the largest poultry producers in the U.S.

Continental Grain and Smithfield Foods combine their cattle feeding businesses to create Five Rivers Ranch, which is eventually sold to JBS S.A.

Launching a new era, the worldwide commodity marketing business is sold, and Continental Grain is reorganized as a holding company so each business can function more independently.

Wayne Farms LLC, which includes Continental Grain’s poultry business, is established as a standalone entity and will become one of the largest poultry producers in the U.S.

Continental Grain and Smithfield Foods combine their cattle feeding businesses to create Five Rivers Ranch, which is eventually sold to JBS S.A.

Transitioning to Investment Holding Company, Maintaining Strategic Focus

Continental Grain creates an investment arm to focus on building businesses and backing strong management teams within the food and agriculture space globally. Conti also supports the team behind Monarch Alternative Capital, forming a new partnership with the distressed debt firm.

Conti begins an official partnership with Rabobank, the world’s leading food and agriculture commercial bank, to invest together in businesses within the food and ag space.

Continental Grain partners with 3G Capital, a leading Brazilian investment group, in the acquisition of Burger King, building on a decades-long relationship.

The sale of Smithfield Foods to WH Group marks Conti’s exit from the pork business.

An investment in Impossible Foods marks Conti’s first direct venture investment and the launch of its venture strategy through an innovation focused division called Conti Ventures.

When HOOPP invests in Wayne Farms, a new long-term partnership between HOOPP and Conti is formed.

Conti takes a stake in Bunge, a publicly traded agribusiness company, and works with the management team to increase shareholder value.

Conti formalizes a new business strategy, called third party platforms, supporting young entrepreneurs and managers who have a specialized view in their field. Monarch, Boulder Food Group, Garnett Station Partners and Irenic Capital Management all form part of this strategy.

Wayne Farms and Sanderson Farms merge to form Wayne-Sanderson Farms, a joint venture between Conti and Cargill and the transformation of Conti’s six decades of operating in the chicken industry. Wayne-Sanderson Farms is the third largest vertically integrated poultry producer in the U.S., with annual revenue exceeding $7 billion.

Continental Grain creates an investment arm to focus on building businesses and backing strong management teams within the food and agriculture space globally. Conti also supports the team behind Monarch Alternative Capital, forming a new partnership with the distressed debt firm.

Conti begins an official partnership with Rabobank, the world’s leading food and agriculture commercial bank, to invest together in businesses within the food and ag space.

Continental Grain partners with 3G Capital, a leading Brazilian investment group, in the acquisition of Burger King, building on a decades-long relationship.

The sale of Smithfield Foods to WH Group marks Conti’s exit from the pork business.

An investment in Impossible Foods marks Conti’s first direct venture investment and the launch of its venture strategy through an innovation focused division called Conti Ventures.

When HOOPP invests in Wayne Farms, a new long-term partnership between HOOPP and Conti is formed.

Conti takes a stake in Bunge, a publicly traded agribusiness company, and works with the management team to increase shareholder value.

Conti formalizes a new business strategy, called third party platforms, supporting young entrepreneurs and managers who have a specialized view in their field. Monarch, Boulder Food Group, Garnett Station Partners and Irenic Capital Management all form part of this strategy.

Wayne Farms and Sanderson Farms merge to form Wayne-Sanderson Farms, a joint venture between Conti and Cargill and the transformation of Conti’s six decades of operating in the chicken industry. Wayne-Sanderson Farms is the third largest vertically integrated poultry producer in the U.S., with annual revenue exceeding $7 billion.

Conti today